A look at Bitcoin in 2015

This article takes a look at the bitcoin landscape today, in terms of the changes we’ve observed around the digital currency during the past few years.

In 2012, a visiting friend from Berlin got me excited about bitcoin. During the next several months, wild price fluctuations, the scent of speculation and spectacular collapses of exchanges like Mt. Gox, caused many to dismiss bitcoin as nothing more than a craze that would eventually disappear like the Dutch Tulip mania of the 1600s.

The focus on speculation at the time obscured the promise of bitcoin’s underlying technology. With bitcoin, the transfer of value—whether $1 or a million—is instantaneous, irreversable and nearly cost free. And its network-distributed “blockchain” provides a level of transparency and accountability that has never before existed in financial transations.

In 2012, my hope was that bitcoin would survive. Today, in September 2015, I’d like to reflect on how it’s doing.

Price stability & adoption

The price of bitcoin seems to have (relatively) stabilized around $240, as seen in this chart from Coinbase:

It hasn’t reached a level of stability that would give me the confidence to hold significant value in bitcoin, but nonetheless it’s an optimistic sign in terms of its liklihood to survive.

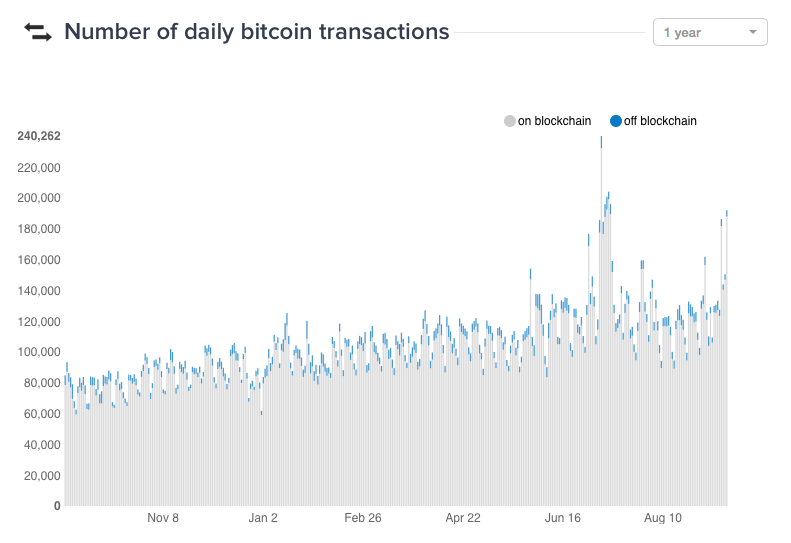

In terms of adoption, it’s also promising to see a steady increase in the number of daily bitcoin transactions.

Many, myself included, imagine there’s only two possible outcomes for bitcoin—that it will eventually replace gold as the world’s principle non-fiat store of value, or that its value will go to zero.

It’s interesting to consider that if bitcoin attained even half of gold’s current $6.5 trillion market cap, the value of a single bitcoin would be worth over $150,000.

Wallet technologies

The emergence of multi-signature wallets allow users to store their bitcoins with providers like Coinbase and BitGo in such a way that they can’t be lost to hackers or mischief on the part of platform staff (think Mt Gox).

The emergence of hierarchical deterministic wallets allow far greater privacy and security, in that a unqiue address can be generated for each transaction, and the entire wallet can be recovered from a complex passphrase in the case of, say, loss of device.

And for those who want to completely delegate custody of their bitcoins to a third-party, we’ve seen the emergence of ultra-secure services like Xapo, who currently lead the market in custody of bitcoins held by large institutions (including the Bitcoin Investment Trust ETF.)

Global financial innovations

As someone who has lived in one country, operated a business in another, hired staff in a third, and serviced customers in a forth, I have direct experience with the friction involved in dealing with border-constrained financial institutions, multiple currencies and slow, costly and outdated monetary transfer mechanisms. (Speaking of which, did you know people still send paper checks in the United States?)

In that context, I’ve been excited to see the emergence of innovative financial products set to disrupt international finance—many of which use bitcoin as an infrastructure or access component, rather than as a currency, taking advantage of the speed, low cost and blockchain validation benefits inherent to the technology, while mitigating risks associated with bitcoin’s price volatility.

For example, Bitwage is a platform working to allow companies to extend payroll services worldwide, from native currency of the business to local currency of the workers, using bitcoin and its network as a fast and low cost transport.

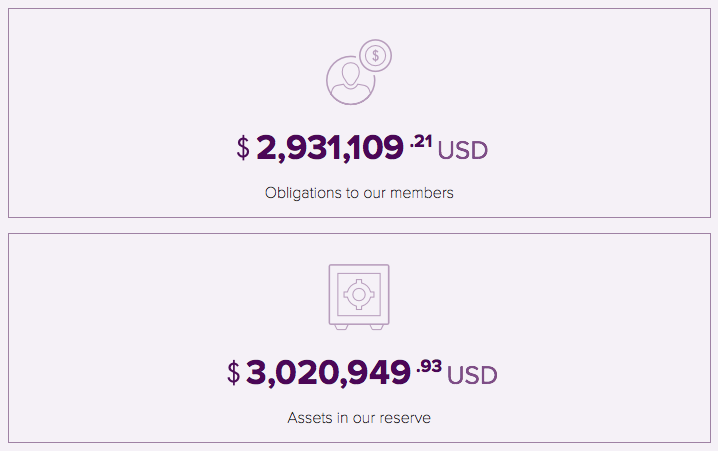

Bitreserve is a product created by one of the Salesforce founders, whose value proposition is to act like a bank, but without exposing its customers to the risks associated with traditional fractional reserve banking.

Once you deposit “value” into the platform via a bitcoin transfer, you can then covert those bitcoin into—and exchange between, cost free!—any of several worldwide currencies, or even precious metals like gold and silver. Visually, they present these as “cards”.

And using blockchain technology, the platform allows public confirmation that, at all times, Bitreserve retains physical reserves of all currencies and metals, equal to or greater than its liabilities.

Since the only way to get funds out of Bitreserve is bitcoin, the platform presently seems to be of minimal transactional utility; however, Bitreserve claim to be in the process of developing interfaces with traditional financial channels like debit cards, bank transfers, etc.

But for the moment, the practical uses of Bitreserve would include, say, holding of one’s cash savings, mitigating exchange rate risks associated with future expenses in a foreign currency, speculation on currencies or metals, or even to retain one’s investment in, say, physical gold (although with a 2% exchange commission, I think BitGold, discussed below, is a better options for that.)

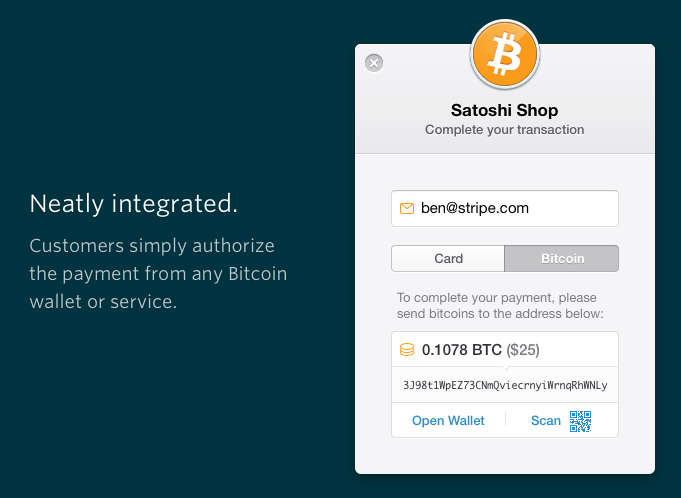

Payment processors like Stripe have integrate bitcoin into their products, allowing businesses to extend product marketing into regions where credit card penetration is lower, but digital currency adoption is higher—e.g. developing nations, and nations with currency instability like Argentina.

Although not directly related to bitcoin, the Canadian company BitGold has brought convenience and improvements to the acquisition, storing and usage of gold.

Previously I used BullionVault as custodian of physical gold, but eventually left due to its inconveniences; for example, their gold accounts can only be associated with one bank account, and so moving funds into and out of the service proved restrictive and involved costly (and error prone) international wire transfers.

BitGold allow you to purchase physical gold through ACH bank transfer, credit card purchase and bitcoin—and even choose among several vaults worldwide for its storage. It’s interesting, however, that when purchasing gold with bitcoin, the only vault option provided is Dubai.

You can sell gold and retrieve funds via ACH bank transfer—to any account you’ve connected—or via a super-convenient pre-paid debit card, available in any of three currencies. If you want, there’s even an option to have your physical gold shipped to your house. Finally, BitGold have promised to allow withdrawals in bitcoin in the near future.

BitGold’s costs are attractive. Purchasing or selling gold is done at 1% within the spot price, and there are no storage costs. I simulated a cost comparsion with BullionVault, who have a lower purchase fee, but charge an annual storage fee. If you hold gold for more than a few years, the overall costs easily work out in favor of BitGold.

Although a relatively new company, BitGold acquired BullionVault’s main competitor GoldMoney, making them one of the world’s largest holders of gold. Exciting stuff!

Future concerns

If bitcoin succeeds, we can imagine ourselves in a world in which we’re transacting daily with the currency as we would today in dollars and euros, in which bitcoin is used as an transport layer to bring speed, low costs and accountability to fiat systems, and in which we possibly store a portion of our wealth in bitcoin.

A concern I have imagining such a world, is government’s tax treatment of digital currencies. For example, the US government currently treats digital currencies as property, subject to capital gains on certain transactions.

That implies a requirement for anyone using bitcoin to continually track cost basis and fiat-equivalent exchange rates when buying and using bitcoin. Such a burden would obviously become impractical in the world described above. Just imagine if every time you earned or spent a dollar, you were required to keep track of the current exchange rate of gold. And imagine if having earned $1,000 in January and later spent that $1,000 in June, you found yourself subject to capital gains tax because, in the meantime, the USD exchange rate with gold had dropped.

Conclusions

Given its relative stabilization in price, observing its continual increase in transaction volume, and witnessing a growing momentum in the emergence of related innovative products and services, I’m more optimistic about the future of bitcoin than ever. It’s exciting to imagine the possibilities that would be enabled in a world in which bitcoin is successful, especially for people like myself, who enjoy geographical independence of home, business, employees and customers.

On the other hand, slow-to-adapt governments already make it difficult for people to operate internationally, and since the widespread use of digital currencies is not particularly in their interest, I foresee governments becoming even larger points of friction in the process of bitcoin realizing its full potential.

In any case, as with past technological shifts, translating unfamiliar concepts into engaging and usable consumer products is an exciting and important design challenge, and one I hope our team at Makalu has the opportunity to take on, whether through helping an innovator’s product to achieve widespread appeal, or in developing our own.

And that’s my current view of the state of bitcoin in September 2015. See you in 2016, and be sure to follow us on Twitter to get notified of the next update.